The Wise Finlaw

By CS Parvesh Bansal

The Wise Finlaw

By CS Parvesh Bansal

How To Find Smart Money In The Market ?

(Practical Guide + Real-Market Examples)

August 04,2025

CS Parvesh Bansal (NISM Research Analyst)

When big investors quietly buy shares, they often know something most people don’t. These “smart money” players use careful research and lots of money to enter stocks before everyone else notices. If you learn to spot the signs that smart money is coming in, you can find strong opportunities early—before news spreads and prices move up.

In this article, you’ll learn the easy ways to find the spot when the big players are entering in a stock, so you can makes master decisions.

(I am writing this article in Hinglish language to make it easily understandable)

Smart Money ya Smart Niveshak कौन है?

Smart Money in India are:-

1. Institutions (like mutual funds),

2. Foreign Institutional Investor (FIIs),

3. Domestic Institutional Investor(DIIs) &

4. Proprietary Desks—जिनके पास capital, research और patience तीनों होते हैं।

There are many technical words like FII, DII, Capital, Research, and Patience I used above. Let me elaborate it

1. FII : FII's are the foreign big fund managers who collect money from foreign people and invest in the Indian market.

2. DII: DII's are Domestic investors like Mutual funds and big fund managers like HDFC, LIC, Kotak etc.

3. Capital: Its earned money that you have for invest in Market and hold in your bank account.

4. Research: It’s an activity to analyse both the fundamental aspect (Like balance sheet, business performance of a company) and technical aspect (indicator, candlestick chart etc.) using various resources.

5. Patience: It’s the mindset of a trader (Read the book Trading in the Zone, Mark Douglas).

Questions in Beginners mind?

01

Kya Retailers अक्सर news देख कर shares me entry karte है.?

02

Jab tak 40-50% move ho chuki hoti hai and smart money quietly apni position पहले strong कर लेता है, और भाव चढ़ने पर profit book kar lete hai ?

03

Jab wo apni profit booking stage par hote hai tab retailer entry lete hai and sochte hai hamare lete hi ye market reverse kyu ho jata hai?

04

Jo chart app dekh rhe hai whi chart sabhi traders bhi dekh rhe hai?

05

98% traders unsuccessful kyun hote hai?

06

Ab me kya karu?

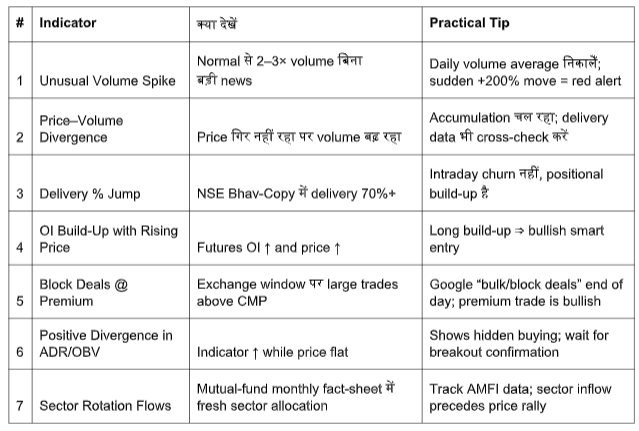

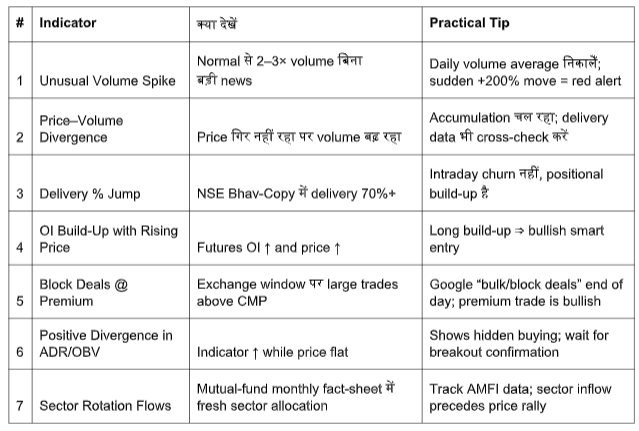

Let us begin the 5 signals given by Smart Investors or Big Investors who take the position:-

1. Unusual Volume Spike

2. Price–Volume Divergence

3. Delivery % Jump

4. OI Build-Up with Rising Price

5. Block Deals @ Premium

In this article we will learn about 5 signals which tell when smart investors are taking their position.

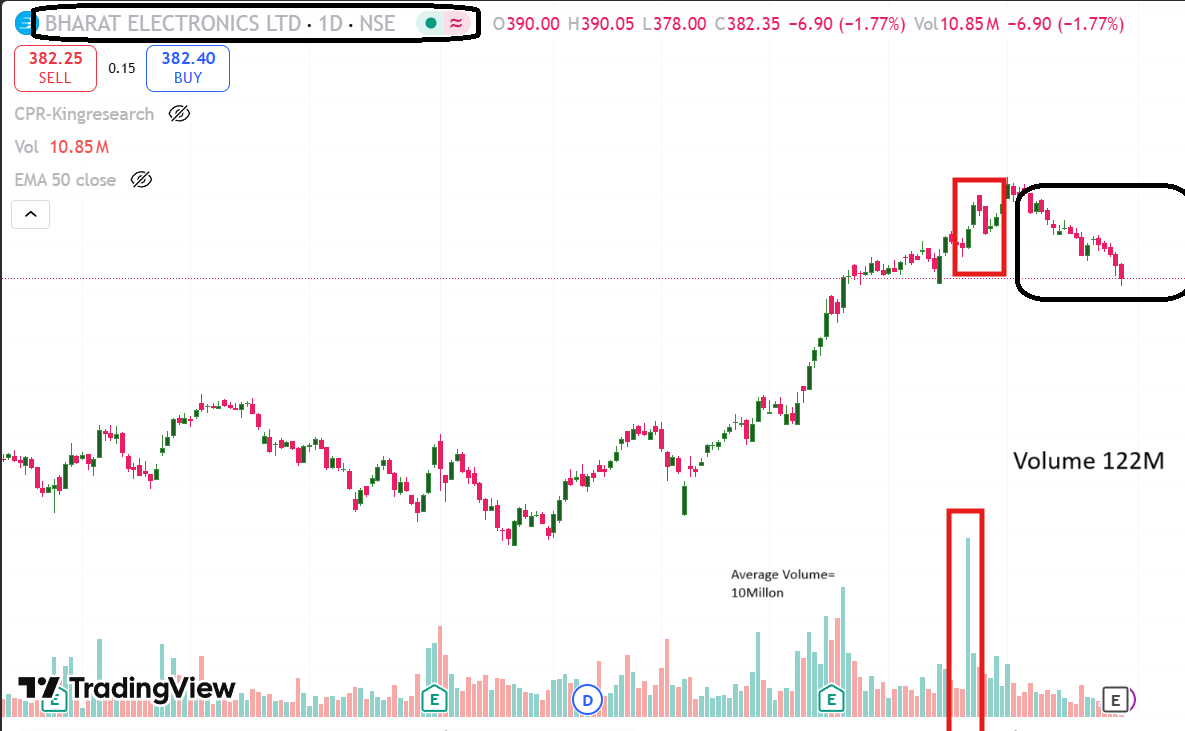

Unusual Volume Spike:

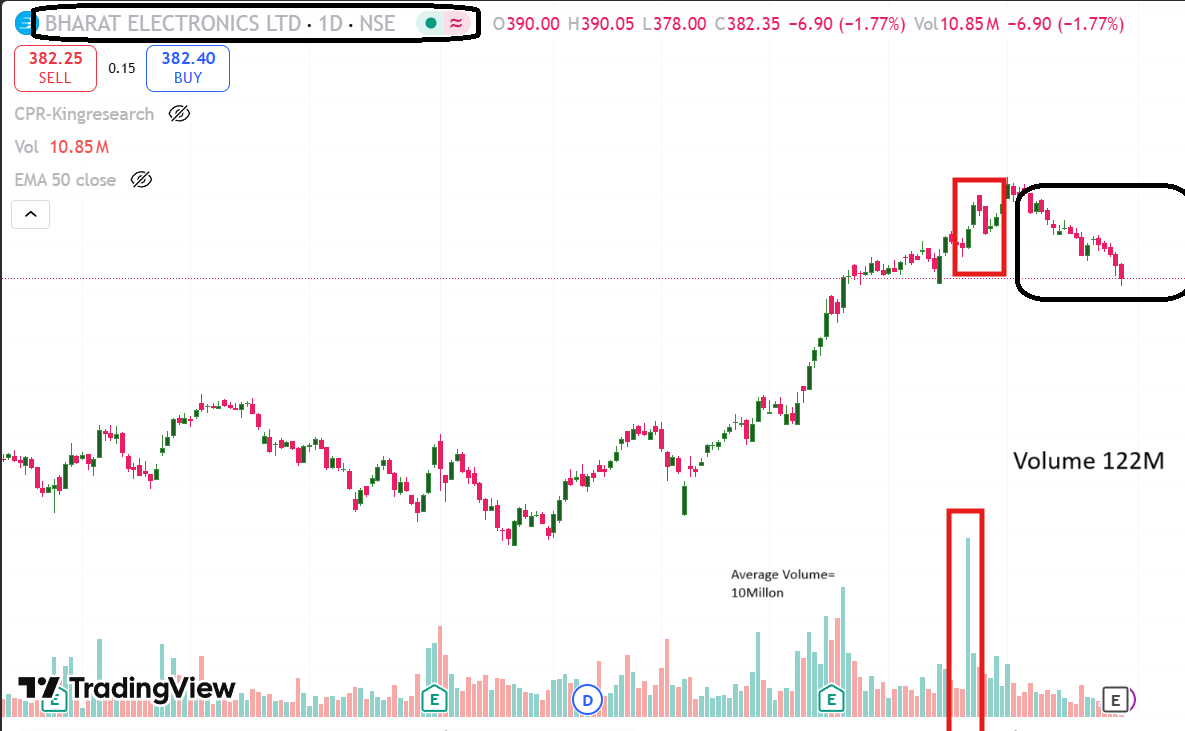

The Sudden change in the volume as compare with average volume of the share. I know you are thinking that its hard to find the share having unusual Volume spike because there are more than 18000 shares are listed in stock Exchange. Example of Arvind Fashion is given here.

Price–Volume Divergence:

Price-volume divergence, also known as momentum divergence, occurs when the price of an asset and its trading volume move in opposite directions, potentially signaling a weakening trend or a possible reversal. This divergence suggests a lack of conviction or participation in the prevailing price trend, which could lead to a change in direction.

Delivery % Jump:

A high delivery jump refers to a sudden and significant increase in the percentage of shares traded on a particular day that are actually delivered to buyers' demat accounts, rather than being just intraday trades. This indicates that more investors are holding the stock for the longer term, showing strong conviction or accumulation rather than quick, speculative buying and selling.

What does a high delivery jump mean?

1. Strong buying interest: A high or rising delivery percentage means buyers are taking actual delivery of shares, indicating serious investing and confidence in the stock's future prospects.

2. Long-term intent: Investors holding shares for a longer period rather than just day trading suggests underlying belief in the stock's value and growth potential.

3. Price confirmation: When delivery percentage rises along with price increases, it suggests a bullish trend with genuine demand. Conversely, high delivery percentage with falling prices could indicate selling or distribution by investors.

4. Smart money activity: Institutional or informed investors often accumulate shares by taking delivery, which can be a positive sign.

5. Less speculation: High delivery stocks usually have less intraday speculation, leading to more stable and reliable price movements.

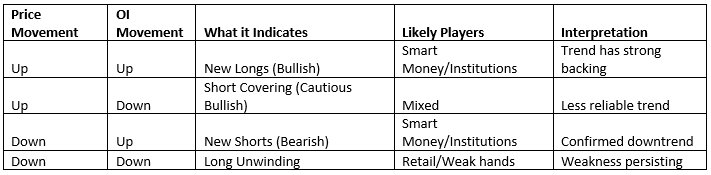

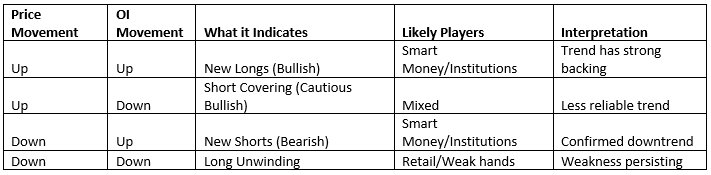

OI (Open Interest)

(Open Interest) Build-Up with Rising Price is a powerful signal in derivatives andoptions trading that can reveal underlying market strength and the activity of "smartmoney"—meaning institutional investors or large market participants.

What Does OI Build-Up with Rising Price Mean?

1. Open Interest (OI): Total number of outstanding contracts (futures or options) that are not yet settled.

2. OI Build-Up: A noticeable increase in open interest, meaning more contracts are being added to the market.

3. Rising Price + Increasing OI: When both the price of the asset and OI are increasing simultaneously.

Suppose NIFTY futures are rising and OI is increasing every day. This is strong evidence that professional traders are building long positions, expecting more upside.

Block Deals @ Premium

What Does "Block Deal @ Premium" Mean?

1. Block Deal: A large, single transaction (≥₹10 crore) executed through a special trading window, not via normal retail trades.

2. Premium: The deal is struck at a price above the stock’s prevailing price band (up to1% higher than reference price). This typically signals aggressive or confident buying.

How Does It Help in Identifying "Smart Money"?

1. Smart Money Signal: When a block deal happens at a premium, it often indicates that an institutional investor (mutual fund, FII, large domestic player) is willing to pay extra for a sizeable stake, reflecting conviction or inside knowledge about the company’s prospects.

2. Accumulation: A premium block deal is a strong indicator that big players are accumulating shares—the classic sign of smart money entering.

3. Trend Confirmation: If the broader price and volume trend supports the move, block deals at a premium strengthen the bullish case.

Where to Find Block Deal Data (NSE)?

NSE Block Deal Watch: Visit the NSE Block Deals Watch page for live and historical block deal data, including details on price, volume, buyer, and seller names if disclosed.

Entry and Exit Points Using Block Deals

Detecting Entry Points

1. Bullish Entry: If you spot repeated or large block deals at a premium on a stock, it can be a leading indicator to enter, especially if the technical trend is positive.

2. Confluence: Combine this with breakouts, volume surges, and other technical signals to increase reliability.

Detecting Exit or Caution Points

1. Caution: If block deals start appearing at a discount (i.e., below market price), or are closely followed by price weakness, this may hint at large players offloading or booking profits.

2. Distribution: Heavy block deals at a premium after a sharp rally might also precede a temporary top—watch other indicators for confirmation.

Important Links Blueprint

1. Simple Google Sheet with columns: Date, Stock, Volume, Delivery %, OI, Block Deal (Link)

2. Use NSE bhav-copy CSV; IMPORT function pulls fresh data daily (Link)

Summary

Disclaimer

यह लेख शिक्षा के उद्देश्य से है; यह buy/sell सलाह नहीं है। अपनी रिस्क-प्रोफ़ाइल के मुताबिक फ़ैसला लें।

Signing Off

CS Parvesh Bansal

(NISM Research Analyst)

How To Find Smart Money In The Market ?

(Practical Guide + Real-Market Examples)

August 04,2025

CS Parvesh Bansal (NISM Research Analyst)

When big investors quietly buy shares, they often know something most people don’t. These “smart money” players use careful research and lots of money to enter stocks before everyone else notices. If you learn to spot the signs that smart money is coming in, you can find strong opportunities early—before news spreads and prices move up.

In this article, you’ll learn the easy ways to find the spot when the big players are entering in a stock, so you can makes master decisions.

(I am writing this article in Hinglish language to make it easily understandable)

Smart Money ya Smart Niveshak कौन है?

Smart Money in India are:-

1. Institutions (like mutual funds),

2. Foreign Institutional Investor (FIIs),

3. Domestic Institutional Investor(DIIs) &

4. Proprietary Desks—जिनके पास capital, research और patience तीनों होते हैं।

There are many technical words like FII, DII, Capital, Research, and Patience I used above. Let me elaborate it

1. FII : FII's are the foreign big fund managers who collect money from foreign people and invest in the Indian market.

2. DII: DII's are Domestic investors like Mutual funds and big fund managers like HDFC, LIC, Kotak etc.

3. Capital: Its earned money that you have for invest in Market and hold in your bank account.

4. Research: It’s an activity to analysis both the fundamental aspect (Like balance sheet, business performance of a company) and technical aspect (indicator, candlestick chart etc.) using various resources.

5. Patience: It’s the mindset of a trader (Read the book Trading in the Zone, Mark Dougles).

Questions in Beginners mind?

01

Kya Retailers अक्सर news देख कर shares me entry karte है.?

02

Jab tak 40-50% move ho chuki hoti hai and smart money quietly apni position पहले strong कर लेता है, और भाव चढ़ने पर profit book kar lete hai ?

03

Jab wo apni profit booking stage par hote hai tab retailer entry lete hai and sochte hai hamare lete hi ye market reverse kyu ho jata hai?

04

Jo chart app dekh rhe hai whi chart sabhi traders bhi dekh rhe hai?

05

98% traders unsuccessful kyun hote hai?

06

Ab me kya karu?

Let us begin the 5 signals given by Smart Investors or Big Investors who take the position:-

1. Unusual Volume Spike

2. Price–Volume Divergence

3. Delivery % Jump

4. OI Build-Up with Rising Price

5. Block Deals @ Premium

In this article we will learn about 5 signals which tell when smart investors are taking their position.

Unusual Volume Spike:

The Sudden change in the volume as compare with average volume of the share. I know you are thinking that its hard to find the share having unusual Volume spike because there are more than 18000 shares are listed in stock Exchange. Example of Arvind Fashion is given here.

Price–Volume Divergence:

Price-volume divergence, also known as momentum divergence, occurs when the price of an asset and its trading volume move in opposite directions, potentially signaling a weakening trend or a possible reversal. This divergence suggests a lack of conviction or participation in the prevailing price trend, which could lead to a change in direction.

Delivery % Jump:

A high delivery jump refers to a sudden and significant increase in the percentage of shares traded on a particular day that are actually delivered to buyers' demat accounts, rather than being just intraday trades. This indicates that more investors are holding the stock for the longer term, showing strong conviction or accumulation rather than quick, speculative buying and selling.

What does a high delivery jump mean?

1. Strong buying interest: A high or rising delivery percentage means buyers are taking actual delivery of shares, indicating serious investing and confidence in the stock's future prospects.

2. Long-term intent: Investors holding shares for a longer period rather than just day trading suggests underlying belief in the stock's value and growth potential.

3. Price confirmation: When delivery percentage rises along with price increases, it suggests a bullish trend with genuine demand. Conversely, high delivery percentage with falling prices could indicate selling or distribution by investors.

4. Smart money activity: Institutional or informed investors often accumulate shares by taking delivery, which can be a positive sign.

5. Less speculation: High delivery stocks usually have less intraday speculation, leading to more stable and reliable price movements.

OI (Open Interest)

(Open Interest) Build-Up with Rising Price is a powerful signal in derivatives andoptions trading that can reveal underlying market strength and the activity of "smartmoney"—meaning institutional investors or large market participants.

What Does OI Build-Up with Rising Price Mean?

1. Open Interest (OI): Total number of outstanding contracts (futures or options) that are not yet settled.

2. OI Build-Up: A noticeable increase in open interest, meaning more contracts are being added to the market.

3. Rising Price + Increasing OI: When both the price of the asset and OI are increasing simultaneously.

Suppose NIFTY futures are rising and OI is increasing every day. This is strong evidence that professional traders are building long positions, expecting more upside.

Block Deals @ Premium

What Does "Block Deal @ Premium" Mean?

1. Block Deal: A large, single transaction (≥₹10 crore) executed through a special trading window, not via normal retail trades.

2. Premium: The deal is struck at a price above the stock’s prevailing price band (up to1% higher than reference price). This typically signals aggressive or confident buying.

How Does It Help in Identifying "Smart Money"?

1. Smart Money Signal: When a block deal happens at a premium, it often indicates that an institutional investor (mutual fund, FII, large domestic player) is willing to pay extra for a sizeable stake, reflecting conviction or inside knowledge about the company’s prospects.

2. Accumulation: A premium block deal is a strong indicator that big players are accumulating shares—the classic sign of smart money entering.

3. Trend Confirmation: If the broader price and volume trend supports the move, block deals at a premium strengthen the bullish case.

Where to Find Block Deal Data (NSE)?

NSE Block Deal Watch: Visit the NSE Block Deals Watch page for live and historical block deal data, including details on price, volume, buyer, and seller names if disclosed.

Entry and Exit Points Using Block Deals

Detecting Entry Points

1. Bullish Entry: If you spot repeated or large block deals at a premium on a stock, it can be a leading indicator to enter, especially if the technical trend is positive.

2. Confluence: Combine this with breakouts, volume surges, and other technical signals to increase reliability.

Detecting Exit or Caution Points

1. Caution: If block deals start appearing at a discount (i.e., below market price), or are closely followed by price weakness, this may hint at large players offloading or booking profits.

2. Distribution: Heavy block deals at a premium after a sharp rally might also precede a temporary top—watch other indicators for confirmation.

Important Links Blueprint

1. Simple Google Sheet with columns: Date, Stock, Volume, Delivery %, OI, Block Deal (Link)

2. Use NSE bhav-copy CSV; IMPORT function pulls fresh data daily (Link)

Summary

Disclaimer

यह लेख शिक्षा के उद्देश्य से है; यह buy/sell सलाह नहीं है। अपनी रिस्क-प्रोफ़ाइल के मुताबिक फ़ैसला लें।